Europe races for energy competitiveness as global ‘Green Wars’ intensify

Europe has a short window of opportunity to formulate a vision and redirect capital to scale up green investments as it seeks to retain industrial competitiveness and stem the flow of investment out of the region and into other countries, particularly the US and China.

Billions of dollars are being pledged globally by the EU, the US and China in an effort to meet stringent net zero greenhouse gas (GHG) emissions reduction targets by 2050, or in China’s case 2060.

The race to stem or reverse climate change is also shaping up to be a race for big investment, innovation, and securing key raw materials where global supply chains will likely become more regional. States, rather than markets, will be taking centre stage initially and global cooperation will give way to more competition as well as protectionism.

The EU’s newly announced Green Deal Industrial Plan (GDIP) would redirect around €250bn ($272bn) from existing funds to fast-track the twin transition to green energy and a digital economy, strengthen industrial competitiveness and upskill employees.

The GDIP proposals published on 1 February build on previous initiatives such as ‘Fit for 55’ designed to cut emissions by 55% by 2030 or REPowerEU which aims to boost the resilience of energy supplies across the bloc.

GDIP also positions itself as a response to the US Inflation Reduction Act (IRA) which has already been signed into law in August 2022 and China’s 1+N framework to reach peak carbon emissions by 2030 and carbon neutrality by 2060. Both pave the way for billions of dollars’ worth of tax breaks and grants offered by Washington and Beijing to attract more investment and preserve competitiveness.

Race against

the clock

Although the EU touts GDIP as the policy package that would help the bloc to lead the clean tech revolution, ICIS research has found that the EU would lag the US and China in multiple areas unless structural problems are addressed urgently.

ICIS estimates the US $369bn IRA will help boost electric vehicle (EV) sales in the US, projecting cumulative sales of 30.6m units or nearly 20% of all units sold in the next 10 years. Prior to the adoption of the IRA in August 2022, ICIS estimated cumulative sales of 15.7m units, or 10.5% of all units sold over the same period.

While the EU has been struggling for three years to produce Delegated Acts on Renewable Hydrogen to lay out its long-term vision for the technology, the IRA is already being hailed as the cornerstone for expanding investments in hydrogen and associated carbon capture and storage (CCS) in the US.

Following the passage of the IRA, US-based ExxonMobil in December announced it will boost planned investments in its Low Carbon Solutions business to $17bn through 2027, compared to $15bn in its plan prior to the adoption of the bill. A large part of this will go to hydrogen and CCS.

China expects that by 2025, the output value of its hydrogen energy sector will reach 1tr Chinese yuan ($147bn), launching to CNY12tr by 2050, with hydrogen accounting for 10% of its final energy consumption.

Meanwhile, although the EU-27 is the second largest chemical producing region in the world, with around €499bn in sales in 2020, leading groups such as Germany’s BASF or Merck KGaA announced plans last year to build major chemical projects in China, adding to a growing number of European investments there.

These are not singular cases.

Jules Besnainou, executive director of Cleantech for Europe, an industry body for green technology, told ICIS how the US Department of Energy employs 200 full-time staff whose responsibility is to evaluate cleantech start-ups across the world and contact them to offer funding.

The competition has reached such a level that French and German economy ministers Bruno Le Maire and Robert Habeck recently travelled to the US to protest the $369bn tax breaks and subsidies package aimed at boosting homegrown US green technologies.

A decade ago, fearing competition from China, Brussels imposed anti-dumping measures against the country, claiming producers of clean technology were receiving unfair subsidies.

Walter Boltz, a senior EU energy advisor, said Europe’s fears over competition with the US and China may be overblown since the EU itself had been allocating generous green subsidies well before the US stepped in to adopt the IRA bill.

Europe structural challenges

Europe’s disadvantage in the global green race, therefore, does not lie in its ability to hand out subsidies but in structural flaws that need to be addressed urgently.

The first relates to setting a clear vision for the future, identifying the sectors where the EU can encourage and promote growth.

Unlike the US IRA or China’s 1+N, which clearly identify the sectors that each country intends to lead in and the steps required to support them, Europe’s GDIP lacks the same level of detail, merely promising to clarify them in future policy packages such as the Net Zero Industry Act or the Critical Raw Material Act, which are due to be discussed in the upcoming months.

The shortcoming lies in the sheer diversity of interests and opinions within the EU-27, which limits policymakers’ ability to produce timely and coherent visions. One example has been the protracted debate on whether hydrogen produced using nuclear or gas-fired electricity would qualify for renewable support.

Cutting the red tape

The second factor involves the need for an overdue simplification of regulations, particularly those related to permitting which have been stifling investment and now threaten to derail the bloc’s green objectives.

One issue that has been repeatedly flagged by experts and industry representatives interviewed for this research has been the absence of pragmatism as well as heavy bureaucracy which investors face when looking to access funding, obtain licenses or scale up production across the EU.

In a note to ICIS, Germany-based specialty chemicals company LANXESS noted it was crucial companies received subsidies with less bureaucratic effort.

In Austria, for example, it may take up to eight years to obtain a licence for ground-based photovoltaics (PV) for solar power. In many cases delays can drag on even longer, particularly if lobby groups take project developers to court.

A key driver in reaching the revised binding target of 32% for renewable energy across the bloc by 2030 will be streamlining the permitting process.

“The rules should be simplified so that if you apply for a licence and don’t get a rejection within six months you can assume you got it,” Boltz said, noting that the new policies should include a proviso acknowledging the public interest of renewable investments.

EU electricity

reform

The third, and perhaps the most critical factor, is the reform of the EU electricity market to accommodate cutting edge technology and guarantee affordable prices for industrial consumers.

The EU’s GDIP proposes to redirect as much as €250bn available via the Recovery Resilience Facility (RRF) to support the greening of industrial production. Another €372bn can be mobilised via the InvestEU Programme for net-zero investments and the latest proposals also stipulate the relaxation of state aid rules.

While the EU is looking to match the generous support offered by the US and China, Boltz argues that neither the IRA’s tax break model nor China’s state aid would fit EU requirements.

On the one hand, Brussels cannot adopt the same tax instruments as the US because of a patchwork of taxation regimes across the bloc which reflect the peculiarities of each member state.

On the other hand, opening up the floodgate to state aid would lead to major disparities across the EU and the fragmentation of the single market as richer countries can afford to hand out more aid than others.

As a result, one of the more reasonable options would be the introduction of an electricity industrial tariff across the bloc that would create a level playing field, Germany-based Wacker Chemie told ICIS.

Europe’s energy crisis unleashed in the wake of Russia’s invasion of Ukraine and subsequent curtailment of gas supplies to the bloc lifted electricity and gas prices to record levels.

By the second half of 2022, for example, baseload electricity prices in Germany averaged €312.00/MWh compared to €85.00/MWh in the US, €155.00/MWh in Japan and €110.00/MWh in Australia, according to data from ICIS and the International Energy Agency (IEA).

As a result of high electricity and natural gas costs, 70% of Europe’s fertilizer production capacity was reduced or halted output in 2022 and the petrochemical industry was still operating at 55% capacity as of January 2023.

Such a disparity is clearly putting Europe at a disadvantage. Even if prices are now on a downward trend, the EU’s energy costs are likely to retain a premium because its fleet of old nuclear, coal and gas-fired capacity needs to be replaced with investments in newer technology.

That said, Europe cannot afford to bide its time in reorganising the energy sector and devising new tools to hand out incentives. It needs to act promptly to retain and enhance its competitiveness as illustrated by research in the sectors covered by ICIS.

“We can’t really wait for new instruments like the sovereignty fund. In terms of market signals that would be too late – 18 to 24 months from now,” Besnainou said.

“The EU is not short of big pockets but oftentimes these are not pointed in the right direction. We need to focus all existing instruments, like the Innovation Fund, on the scale-up and deployment of clean technologies,” he added.

Electricity

While policy packages adopted in China, the EU and the US envisage support for all types of green technologies, there are significant differences across regions.

In the EU, the electricity market is now under review, with proposals to promote corporate power purchase agreements (PPA) and contracts for difference to meet sustainability targets while hedging against potential price volatility in the wholesale power price.

The main problems currently preventing the PPA market from taking off concern the demand side. Indeed, the market has been so far dominated by very large companies, with specific needs and levels of expertise.

In the US, overall tax credits in excess of $200bn provide for investments in solar, wind, nuclear and battery storage as well as grid expansion and upgrades, and energy efficiency measures over the next decade.

A study by Boston Consulting Group found that investment in solar, offshore wind and battery storage can reduce production costs by up to 50% following the introduction of the IRA.

In China, the green bond market has now risen to become the second largest in the world after the US, with a total balance of $270bn as of June 2022.

China has been pouring trillions of yuan into renewable power generation. In 2021, its clean energy investments reached $380bn, ranking first in the world. Some of these projects are materialising into large-scale projects such as the 450GW wind and solar capacity in the Gobi Desert.

Achieving peak carbon by 2030 and neutrality by 2060 may require up to $570bn in green investments annually, according to official data.

While the US tax breaks are designed to give clear market signals, in the EU cleantech start-ups which are generally supported in the early stage of development find themselves struggling when looking to scale up, Besnainou said.

Natural gas

The IRA also opens up more opportunities for onshore and offshore oil and gas exploration provided these align with emissions reduction targets through the expansion of carbon capture and storage (CCS) projects.

The law initially imposes penalties of $900/tonne of methane emitted until 2024, with the fee set to increase to $1,500/tonne afterwards.

Although the American Petroleum Institute (API) raised questions about the provisions of the IRA, describing them as ill-advised and failing to address questions facing the oil and gas sector which continues to cover 70% of US energy needs, market experts say large scale investments in domestic hydrogen and CCS could free up more natural gas for exports to Europe and Asia.

Hydrogen

Hydrogen and carbon capture and storage (CCS) are key components of the US IRA as the Biden administration expects industry and in particular oil refining to make a transition to using blue and green hydrogen.

Blue hydrogen employs CCS to capture CO2 while green hydrogen is produced through electrolysis of water, using renewable energy – typically wind and solar. Traditional or grey hydrogen is produced from natural gas with no CCS.

The IRA enhances tax credits for capturing CO2 (blue hydrogen), creating clean hydrogen tax credits awarded based on how much CO2 is emitted per kilogram of hydrogen produced.

The IRA also increases tax credits from up to $35/tonne for captured CO2 used in enhanced oil recovery (EOR) or in certain industrial applications, and up to $50/tonne for CO2 in secure geological storage, to $60/tonne and $85/tonne, respectively.

The US Bipartisan Infrastructure Law, which complements the IRA, includes up to $7bn to establish up to 10 clean hydrogen hubs in the US.

ExxonMobil is seeking to lead one such cross-industry hub near Houston, Texas which could involve total investment of around $100bn, and capture and store 50m tonnes/year of CO2 by 2030 and 100m tonnes/year by 2040.

ExxonMobil in January awarded a FEED (front end engineering and design) contract to build what it calls the world’s largest low-carbon hydrogen facility at its site in Baytown, Texas. The project would produce 1bn cubic feet (bcf)/day of blue hydrogen (with CCS) and also offer CCS for third-party CO2 emitters. The CCS project would be able to store up to 10m tonnes/year of CO2.

For ExxonMobil’s Baytown olefins complex, the project could cut CO2 emissions by 30% if hydrogen is used to fuel cracker furnaces instead of natural gas. A final investment decision (FID) is expected in 2024 with start-up planned for 2027-2028. The Baytown project would be an initial contribution to the Houston hydrogen and CCS hub.

Dow estimates it would take between 6-8 hydrogen and CCS hubs in strategic locations to decarbonise as much as 85% of the entire chemical industry in the US, citing an analysis done with the American Chemistry Council (ACC).

UK-based BP in its Energy Outlook 2023 sees US low carbon hydrogen usage increasing to 4m tonnes/year in 20230 and 26m tonnes/year by 2050 from minimal levels today.

In China, it is expected that by the middle of the century, hydrogen-based energy will account for more than 10% of the final energy consumption and the annual output value of the hydrogen industrial chain is expected to reach CNY12tr, becoming a new driver for economic growth.

In Europe, there is likely to be one main support mechanism: the European Hydrogen Bank. This initiative will bridge the cost/price gap between grey and green hydrogen. Alongside this, there is the German scheme called H2Global, that awards 10-year tenders to hydrogen producers outside the EU. H2Global buys hydrogen from the lowest bidder and then sells it back to the market to the highest bidder.

The EU released its Hydrogen Strategy in 2020 and set a target of 10m tonnes of renewable hydrogen to be produced and another 10m tonnes to be imported by 2030. It earmarked €5.4bn in mid-2022 and said it was aiming to support 41 projects in 15 member states.

The recently adopted delegated act ensures that market participants seeking to contribute to the 10m tonnes of renewable hydrogen imports by 2030 would be allowed to do so, provided they adhere to the conditions included in the act.

Although Brussels is keen to encourage the uptake of clean hydrogen in highly polluting industries such as steelmaking, there is still a pressing need to introduce certificates proving the fuel is produced using clean technologies rather than fossil fuels.

Despite heavy and often ambiguous regulations, which EU industrial producers generally complain about, Sweden-based H2 Green Steel plans to build a world-scale green hydrogen-powered steel facility in the north of the country. The company is targeting 5m tonnes of green steel production by 2030 with 95% less CO2 emissions versus traditional steel production.

Transport

One of the goals of the IRA is to foster the electrification of mobility in the US. The IRA provides for a federal $7,500 per electric vehicle (EV) tax credit.

Batteries are the most expensive component in an EV, accounting for 35% of cost, but US auto companies do not assemble batteries themselves, relying instead on a long global supply chain, with chemical processing, components and assembly largely done in China. However, US auto manufacturers are increasingly seeking to produce batteries in the US through joint ventures with battery technology companies.

The IRA also set stipulations on battery minerals and components for vehicles to qualify for the full amount of the federal EV tax credit. These provide incentives for North American-built batteries and penalises companies that source batteries abroad. This will lead to development of a North American supply chain for EV batteries, building upon incentives already provided by the infrastructure bill passed in late-2021. This will accelerate the local supply of EV batteries in the US.

With the passage of the IRA, ICIS analysts now project cumulative US sales of EVs during the next 10 years of 30.6m units, or 19.9% of all units sold. As recently as last summer, the assessment prior to the adoption of the IRA was for cumulative sales of 15.7m units.

Polypropylene (PP) is the primary resin for EV battery cases with a typical EV containing 40-107 kilograms (kg) of PP per vehicle. The boosted demand for EVs arising from the IRA could lead to additional cumulative demand for PP totalling at least 1.2m tonnes over the next 10 years.

In contrast to the US IRA, the Chinese government discontinued subsidies to buyers of EVs, which were first introduced in 2010.

Industry analysts expect demand for EVs to transition from being policy-driven to being market-driven and there are indications that some regions such as China’s southernmost province of Hainan may be considering banning combustion vehicles by 2030.

The EU’s EV strategy remains the most radical, introducing new rules to sell only EVs after 2035, but this could hit multiple challenges as the supporting infrastructure is not yet in place.

Biofuels

The US biofuels sector has been allocated $500m through the Higher Blend Infrastructure Incentive Program at the US Department of Agriculture, with the goal to increase the sale and use of higher blends of ethanol and biodiesel.

In contrast, the EU has not set out any specific budgets yet to support the European biofuels sector.

The US IRA provides extension of tax credits for second generation (waste-based) biofuels development in the US. This is a shared goal that the US and EU have, with the EU aiming to provide member states the flexibility to support advanced biofuels projects with state aid.

Without adequate measures to support growing demand in Europe, producers are likely to struggle against competitively priced imports from the US and South America.

Chemicals

Chemicals and polymers also stand to benefit from greater investment in the green energy transition.

However, the timing of opportunities for the chemical sector from the EU Green Deal Industrial Plan (GDIP) is still uncertain, at least relative to the immediacy of project growth stemming from the US IRA, according to investment bank UBS in a recent research report.

For epoxy resins, the wind power segment is a key growth area in Europe and globally, in line with the heightened sustainability focus and the path towards a carbon neutral future.

An additional 563 GW of wind power is required by 2030 to reach a projected 1,400 GW globally by 2050 based on current growth rates and 3,200 GW to reach the 1.5C Paris Agreement climate goal, according to Global Wind Energy Council (GWEC) data. This equates to around 1.7m tonnes of demand for epoxy systems for 2030 and 7m tonnes of demand to reach the Paris Agreement climate goal for epoxy systems, respectively, a European epoxy producer told ICIS.

However, what will determine the EU’s industrial competitiveness to a large extent is its energy costs.

Last year’s energy crisis has dealt a major blow to Europe’s industrial producers, with many still struggling to recover, even as electricity and gas prices are reversing an all-time high premium.

Even as natural gas costs have fallen to a 16-month low, any economic recovery may be muted at a time when producers in the US or Asia are at an advantage with comparatively cheaper prices.

The EU has launched a consultation for the reform of the electricity market, expecting to turn the focus on power purchase agreements (PPAs) and contracts for difference, which would provide electricity producers with a fixed price for their output while cushioning consumers from volatile energy bills.

More predictability would be welcome although many chemical producers are calling for the introduction of a uniform industrial tariff across the bloc.

Last year, Germany allocated no less than €200bn to support industrial production, a move that was heavily criticised by other member states that could not match the level of incentives offered by Berlin.

Talks of more state aid being allowed towards greening industrial production are bound to perpetuate disagreements and fracture the single market.

Speaking to ICIS, Julian Popov, a member of the advisory council at the EU’s largest public-private partnership Climate-KIC and the European Council on Foreign Relations agreed Europe had been facing unprecedented challenges caused by record energy prices but said its emissions market was sufficiently functional to incentivise decarbonisation.

This may not be the case in China, for example, which is still struggling to establish a carbon and electricity market.

Yet the reform of the EU market may take longer to implement, which means that many chemicals producers will have to find sustainable solutions to adapt to the new market reality.

This may already be the case in the fertilizer and agriculture sectors where the production of nitrogen fertilizers has been reduced as a result of high gas costs.

The chemical industry is the fourth largest industry in the EU, accounting for around 7% of manufacturing output by turnover.

It directly employs 1.2m highly skilled workers and supports 3.6m jobs indirectly, supporting a further 19m jobs across all other value chains.

With 67% greater labour productivity than the average for the manufacturing sector, the EU’s chemical industry is one of the drivers of economic progress and innovation.

How much it will be able to retain and further develop its strengths will depend on how quickly and efficiently the EU will be able to provide a clear vision for the future.

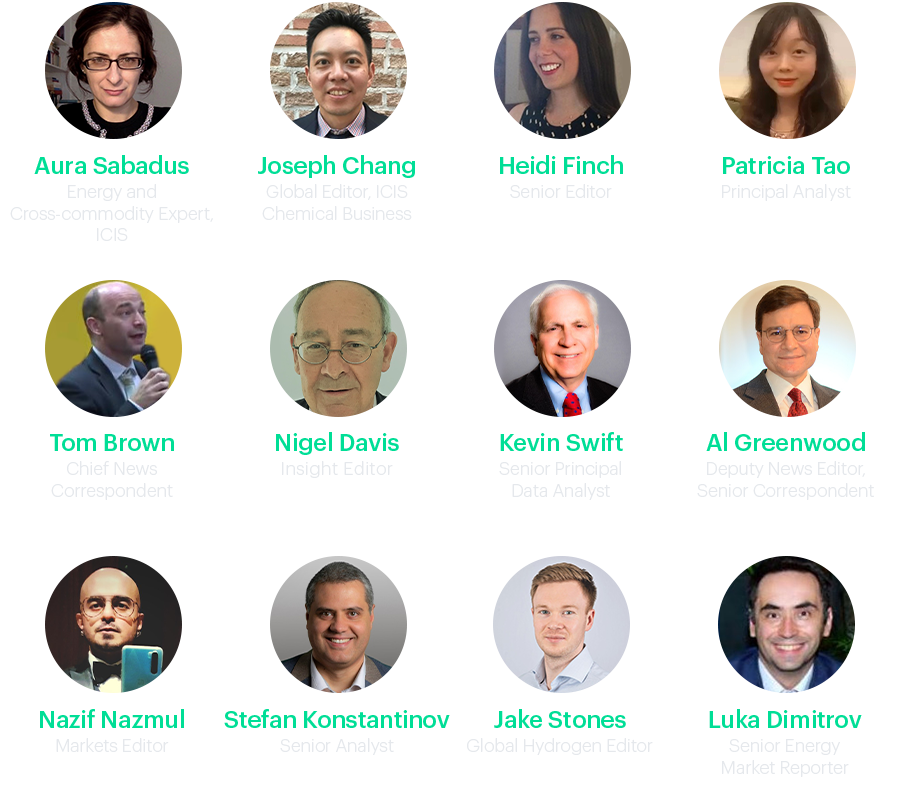

Authors:

Data and graphs: