The global energy transition:

impossible challenge or

unique opportunity?

ICIS Energy Series, August 2022

In recent years, lawmakers and regulators have provided some watershed moments expediting the global energy transition. From the catalysing effect of the Paris Agreement in 2015 to today where we have firmly ventured into target-setting and national, sectoral and corporate commitments across the globe. Regardless of legislation, however, consumer demand and generational shifts are playing a key part in forcing change on energy markets, the economy and business operations. The factors influencing large corporations are a heady mix of reputational management, ESG, financial drivers and an unequivocal sense of societal change.

Click to find out more and follow us on LinkedIn for more from the ICIS Energy Series.

Energy: The state of play today

“It’s really a transformation of how we live, how we work and how we produce. It will touch every piece of what we know.”

Stuart Wood, Head of Energy Commercial Strategy, ICIS

The impact of the global energy transition on trading markets is complex. Companies are now readdressing what their businesses will look like in five, 10 and 25 years, how their funding will be affected and how to retain their clients amid the shake-up. Renewed expectations of up-and-coming generations also reinforce the impetus for change:

“Whereas 20 years ago, there would still have been questions over the science of climate change from some quarters, it's now largely accepted.

The generation that might have questioned has been replaced by the generation that accepts the facts, and then coming behind that is the generation that could make decarbonisation happen and, ultimately, act upon this need.” Jamie Stewart, Managing Editor, Energy at ICIS.

Wind and solar power entered the energy markets heavily subsidised but today, these technologies can, in many places, compete with more established forms of power generation, proving to be more economical to business operations in the long-term. ICIS experts say we are edging towards this pivotal point globally with greener fuels beginning to compete like-for-like on lifetime costs with carbon-heavy fuels. The ability to store surplus renewable electricity at commercial scale and use it when it is most needed – in its relative infancy but slowly being brought to market – will also have a profound impact on global efforts to decarbonise.

Therefore, economic growth can be sustained alongside the development and interjection of cleaner fuels. For example, we have now seen carbon reduction and economic growth coexisting in Europe. Moreover, renewable energy will have a key role to play as Europe looks to cut reliance on Russian gas supplies over the months and years to come. There is a clear acknowledgement in today’s economy of the need to adapt business models and mentalities in line with the low-carbon transition if those models are to be relevant to consumers and shareholders over the next 20 to 30 years.

At ICIS, as the integrated energy experts we know our large energy customers are adopting and embracing this transition. Oil majors that were previously considered slower adopters of greener fuels are today making significant investment in renewables such as wind, solar and hydrogen, reducing their exposure to upstream oil and changing mindsets around the type of service they supply. There is a great opportunity for oil companies to help lead the transition, to become retail companies, actively delivering renewables and building electric charging stations.

A global role for gas

“Global energy markets have never been more interconnected. New supply and demand forces and the liberalisation of LNG markets are underpinning the formation of a global gas market, with Europe and the ICIS TTF rapidly emerging as the global benchmark for this market.”

Ben Wetherall, Market Development Director - Global Energy, ICIS

Expert Q&A on the global energy transition - Jamie Stewart, Managing Director, Energy at ICIS:

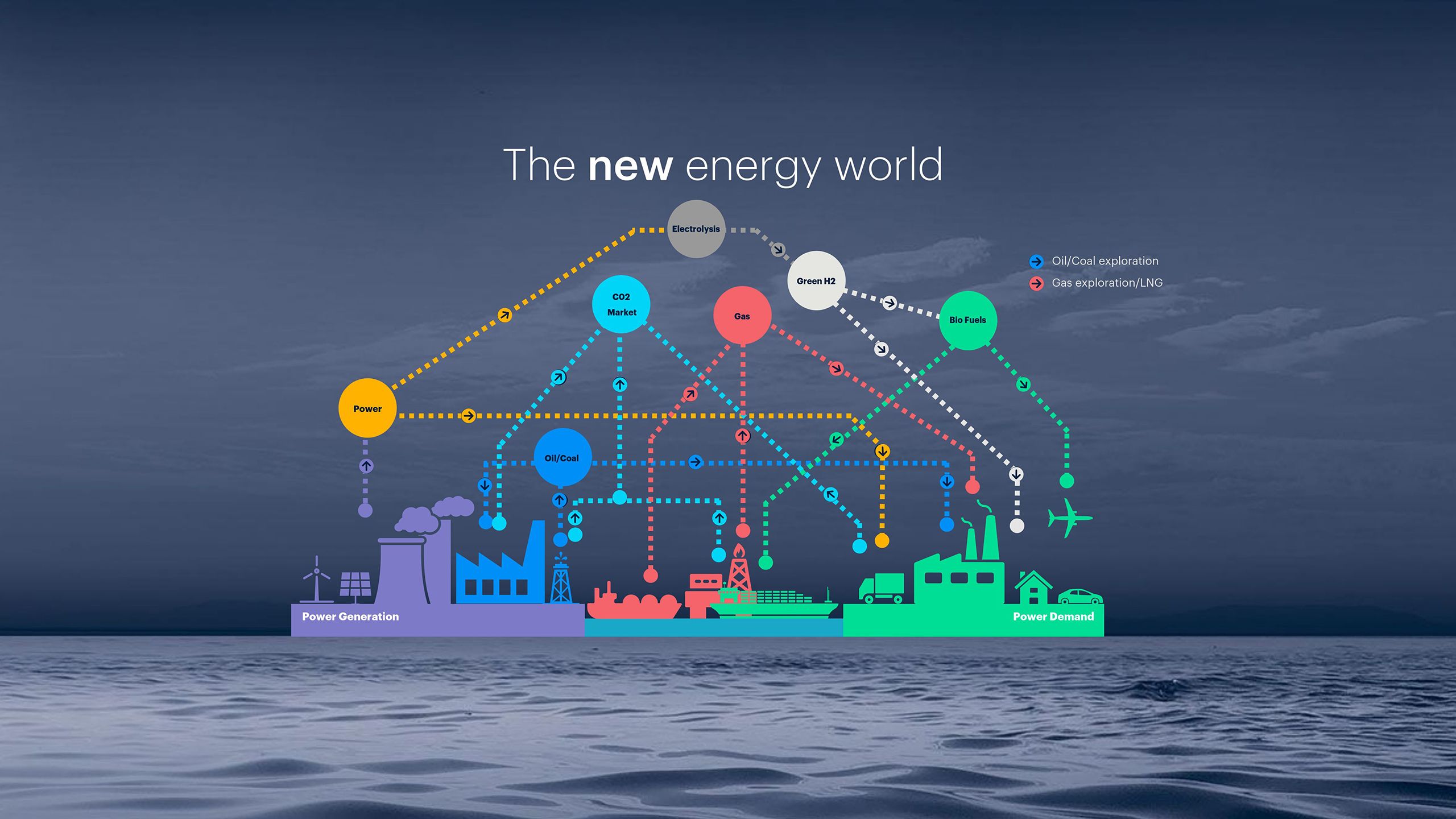

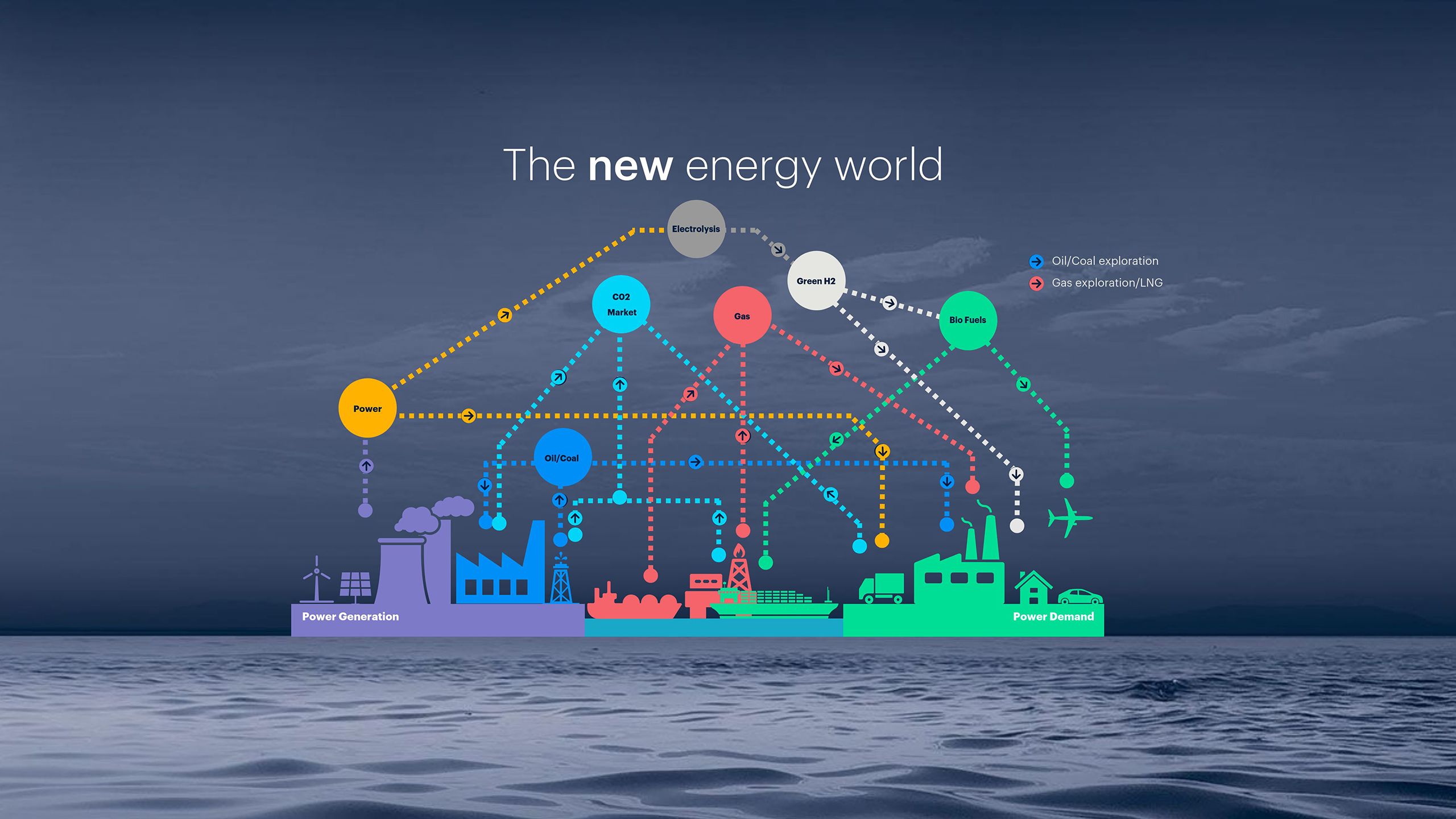

When looking at the progress of energy over the next 30 years, it is important to consider every element of the energy complex – oil, gas, LNG, electricity, renewables, carbon, hydrogen – in decarbonising the economy. LNG, gas and hydrogen are the building blocks for change in this arena. Gas demand in Europe is predicted to grow over the next five to 10 years, plugging gaps left by more polluting fuels and nuclear. LNG is firming the global links between European, US and Asian gas markets, which presents an opportunity for those selling gas to Asia, the US and to Europe to consider a global benchmark to provide clarity over pricing strategies. The ICIS TTF global gas benchmark is among the most liquid reference points in the world with a depth of liquidity rarely seen in commodities markets.

Our analysts believe that an integrated view of the full suite of fuels is essential for organisations to build a picture of how the industries will progress – whether it be two weeks from now, or 30 years into the future – and this is where our products can support businesses.

While hydrogen infrastructure is being considered by many countries in Europe, the role of some global energy companies in the transition is pivoting towards a utility focus, with hydrogen playing a leading role in this:

“The deployment of hydrogen will be crucial in transforming those hard-to-decarbonise industries and the heavy transport sector, as well as helping to balance intermittent renewable generation. With more ‘traditional’ oil and gas companies adopting net zero emissions targets, they are having to adapt their business models to the new realities, with more investment in renewables, hydrogen production and the development of a hydrogen market.” Ben Wetherall, Market Development Director - Global Energy, ICIS.

ICIS hydrogen expert, Jake Stones, explains our offering in this area:

“Within our ICIS analytics modelling, we forecast how much hydrogen will be needed. There is also the question of when and how can we get it from A to B? Who's going to use it? What policy support is going to be in place? And the key thing – how much is it going to cost?

No-one knows what this emerging energy source is really going to cost, because we haven't yet got it at scale, meaning you can't create a business model. This is one of the problems that our blue and green hydrogen pricing indicators solve.”

Click to find out more and follow us on LinkedIn for more from the ICIS Energy Series.

C-suite and finance –

why the future is green

"All across the value chain, from producers to shippers to buyers, companies are looking through the ESG lens in order to comply with net-zero goals, which could eventually become mandates, depending on the region.”

Ruth Liao, Americas Editor, LNG, ICIS

So, how is this affecting the way senior executives are navigating the new economy? ICIS expert, Luka Dimitrov, says that finance surrounding greener fuels is an investor-driven market, and the sustainable finance industry is well-matured. It is now more profitable to issue a green bond in today’s economy than it is a traditional bond that is not linked to ESG. This means that investing in sustainable fuels is financially sound and it makes business sense to cut carbon and divest carbon intensive initiatives.

Investment in ESG funds is on course to reach a record in 2021, and analysis shows that companies that invest in ESG see higher equity returns. Positive scores will invariably attract more funding into the business, creating a virtuous circle with cyclical rewards for sustainable finance.

“Strong ESG scores are vital for attracting funding, and in Europe, we can see EU mandates pushing companies into it. The alternative is that companies lose buy-in from the investment community and their share price suffers as a result.” Bee Lin Chow, Head of Asia Energy Analytics, ICIS

The lack of standardised data on companies’ ESG strategy and how to measure carbon neutrality poses a challenge, however, and shareholders and investors are looking for transparency and investment in both areas. Consumers also expect a level of detail on how leaders plan to take their companies to net zero, rather than just broad statements.

How digitally transformed is your business? How easily and accurately can you record your progress on the transition to net zero? What data sets do you have internally and how effectively does information flow? Can you provide clarity of supply and demand to your customers?

These questions are of relevance both in reflecting ESG commitments, as well as how to provide clarity to customers, making investment in tracking, managing emissions and machine learning, that are critical to inform business decisions in the transition.

What are the future

challenges for energy?

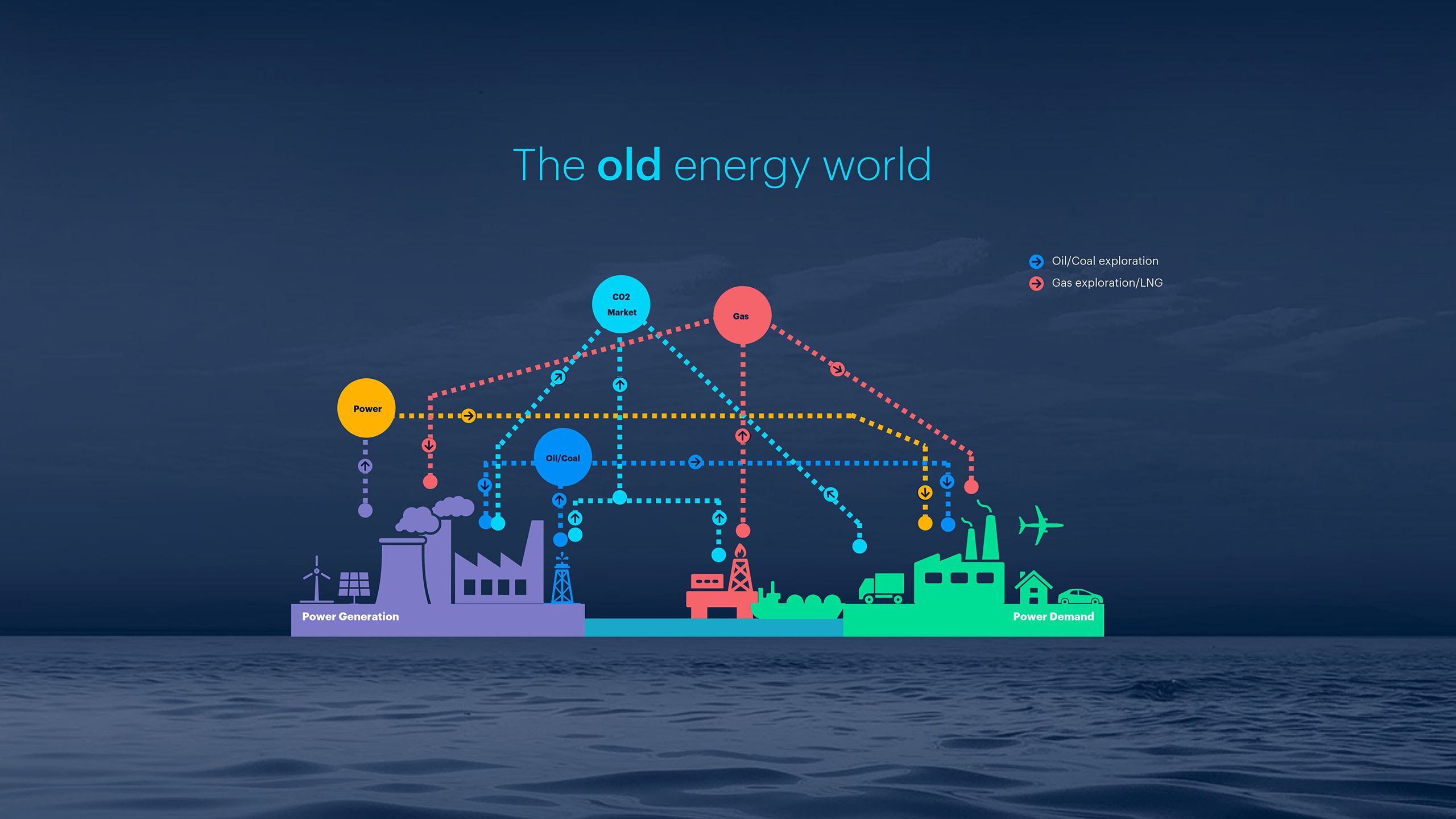

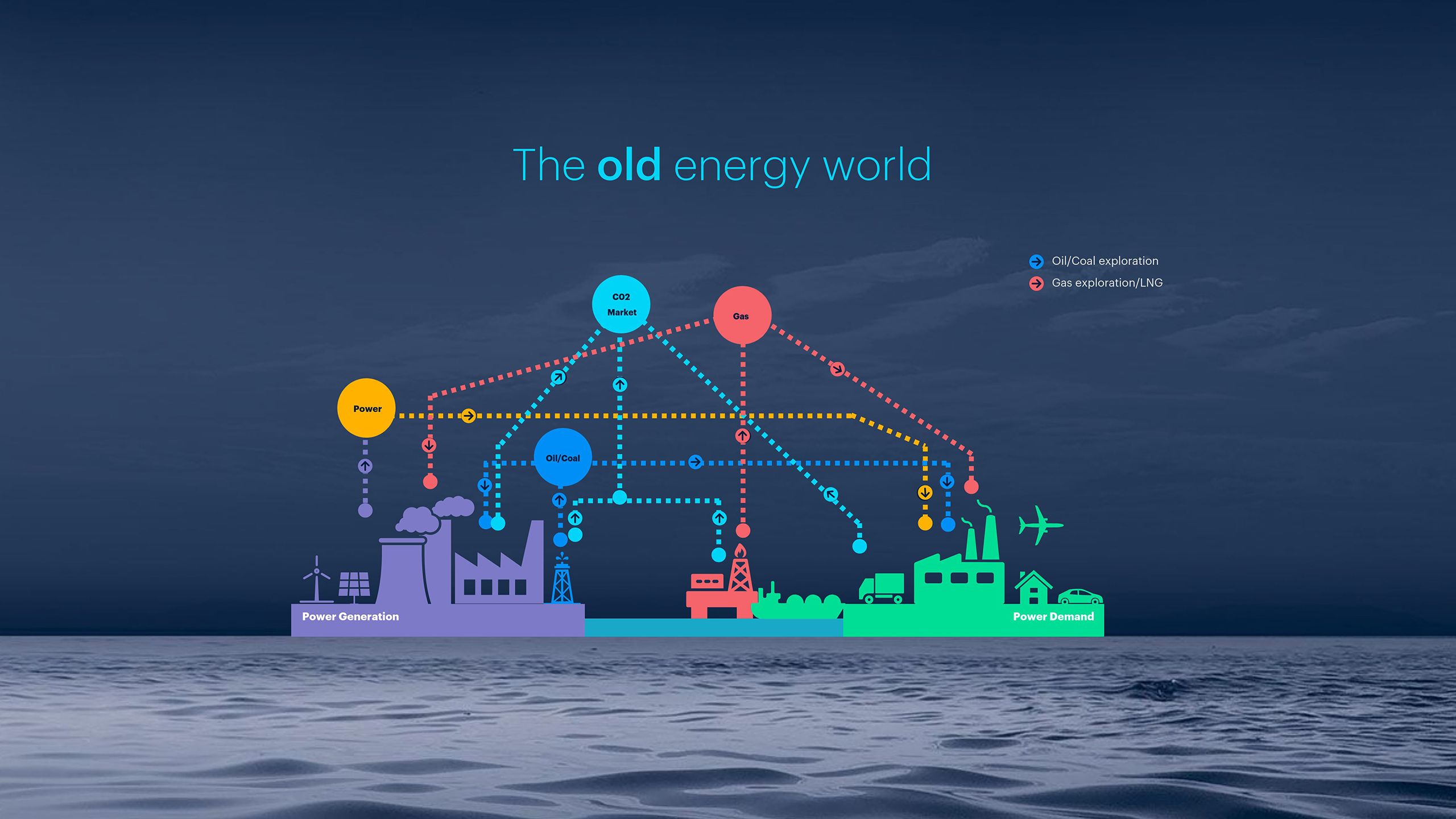

"The Energy industry is changing arguably faster than at any time in its history.

Companies are working through the net zero change away from legacy fuels, such as Coal and Oil, using transition fuels such as Gas, increasingly utilizing Wind and Solar to create ever more Electricity, whilst also assessing the developing Hydrogen markets.

This change poses new questions for the industry: ‘What is our business going to look like in 5, 10 and 25 years? How and where are we going to operate? What clients will we serve? What's going to be different from what we do today?‘

Intelligent information, harvested and crafted by markets experts, enables companies to make better decisions. To have hindsight, to look back at historical trends and see how that may shape the future, to use insight to understand market implications as they happen and to use foresight to understand future impacts and map a different course.

This intelligence is needed now, more than ever, to navigate the change to net zero, whilst managing the reality of the need for profitable business."

Stuart Wood, Head of Energy Commercial Strategy, ICIS

For energy companies, the push to deliver and scale-up clean fuel generation requires substantial investment, and a move away from fossil-fuel generation will often impact short-term earnings.

The challenge for senior executives in the industry is how to optimise day-to-day operations, whilst also crafting strategies to ensure business thrives in this new environment.

As the energy transition unfolds, progress to net zero will speed up. Organisations the world over must be ready to change, if the global energy transition is to be turned from an impossible challenge into a unique opportunity.

Seeking guidance? ICIS has a wealth of knowledge, data forecasts, insights, industry experts, data scientists and meteorologists, tracking energy outputs up and down the value chain, with forecasting data into next week, and the next 50 years ahead. Our technologies, artificial intelligence, machine learning and deep neural networks blend content on every energy type to support you in making informed decisions.

Click to find out more and follow us on LinkedIn for future updates.

Read more from the ICIS Energy Series:

The rising tide: how the world’s markets must grapple with high energy costs - Focus on LNG